Medicare supplement Insurance Plan – How to Compare Medigap Plans

There are a number of Medicare supplement (Medigap) plans available to seniors. All have different rules, coverage, restrictions, and levels of coinsurance. If you are looking at these choices, you are likely wondering how to compare Medigap plan prices. There is no one approach that works across all of them. In this article, we will discuss some helpful suggestions that can help you make the best Medicare supplement plans 2022.

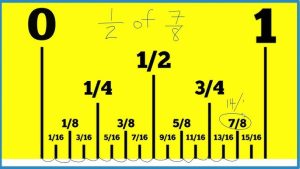

The first guideline to use is that you should consider the level of coinsurance that you need for your monthly expenses. Medicare Plan N 2022usually covers 100% of your Medicare Part B coinsurance expenses, except for those that apply to inpatient hospitalizations, emergency room visits, and home care. You need to find the amount of monthly premiums you can afford to pay in order to balance out the difference between the original Medicare coverage and the medigap plans. The higher the monthly premiums, the higher the deductible, so keep that in mind when deciding how much of a premium you can reasonably afford.

Second, you should consider the different deductibles that are available. The deductibles that are available under Medicare Parts A and B vary dramatically. Some high-deductible plans have a single low-cost deductible option, while other high-deductible plans have two or more options with varying levels of coinsurance. To make comparison easier, consider how much you can afford to spend out-of-pocket on your monthly expenses for each of the different medigap plans. This will help you narrow down your options to the plan with the lowest cost and the most options.

Finally, ask the Medicare representatives about the co-payments and out-of-pocket costs for each plan. Even though the prices are set by the insurance companies, there are differences in what they will charge for these services. Most often, a media plan f will cover all of the in-network hospital costs listed on your original Medicare schedule. A few companies will also cover the costs listed in any of the following plans: PPO (Preferred Provider Organization), HMO (Preferred Provider Organizations), and Indemnity Plans. It’s important to remember that if the quoted price doesn’t include coverage for services in one of these options, it probably isn’t a true representative of what you’ll be paying if you use the Medicare service.

One thing to consider is whether you’re covered for pre-existing conditions. A few states do not cover this coverage when you first purchase a Medicare part or medical plan. The Medicare coverage usually ends once you’ve reached the age of 65, regardless of whether you’re under age 65 or not. Medicare part b medical expenses, including hospital care, can’t be included in the Medicare supplemental insurance plan unless you’ve met the age requirement. If you or someone you know has been diagnosed with a pre-existing condition, it’s a good idea to discuss it with your Medicare representative.

It’s also a good idea to compare the prices of different plans before you buy your own Medicare supplement insurance. Most health insurance companies provide quotes via the internet. In fact, many of them have online quotes available to their potential customers. These quotes are usually pretty easy to understand and provide a good overview of what you should expect. When comparing rates and types of coverage, make sure to stay abreast of changes to the Medicare program.